Summarize and analyze this article with:

Payroll automation is a critical component of modern Human Resources Management (HRM) systems. It streamlines the process of calculating employee salaries, managing benefits, and ensuring compliance with tax regulations. In this guide, we’ll walk you through the steps to create a Payroll Automation Module for HRM, and how FAB Builder can help you achieve this efficiently with its low-code platform.

What is a Payroll Automation Module?

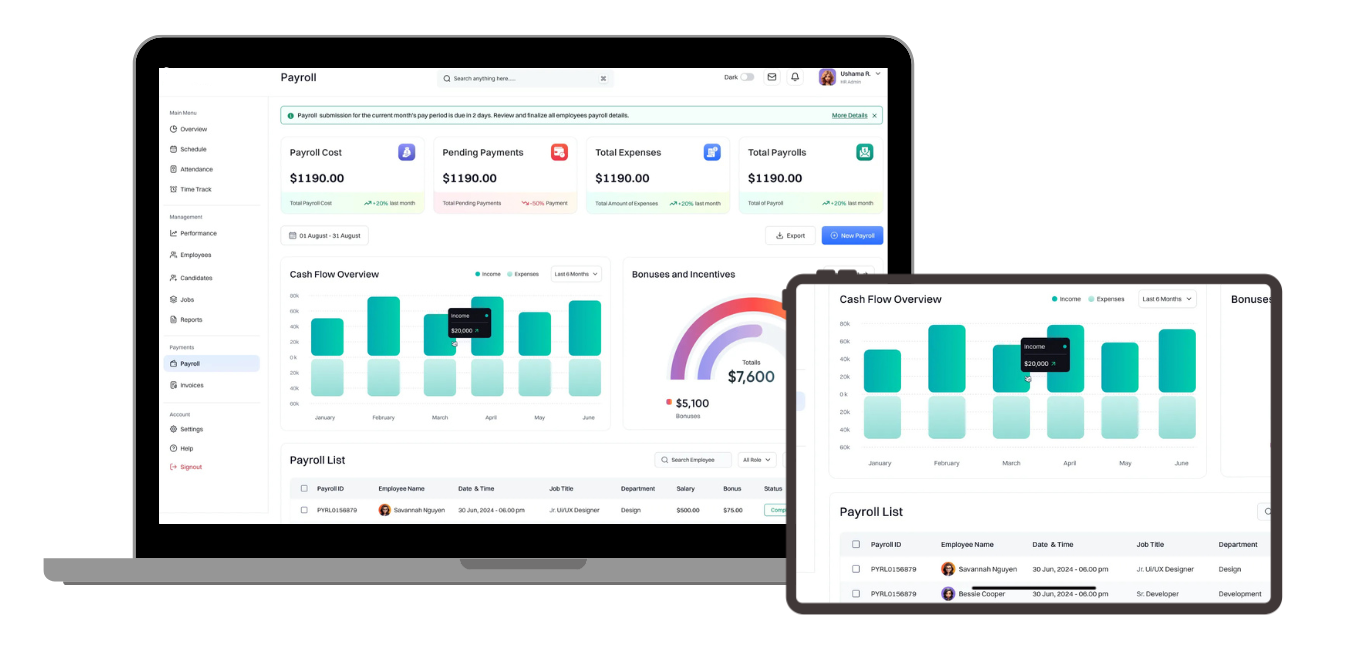

The Payroll Automation Module in HRM is designed to streamline the processing of employee salaries and benefits. It automates calculations for wages, taxes, bonuses, and deductions, ensuring accuracy and reducing manual errors. The module also manages direct deposits, generates payslips, and handles statutory compliance by calculating tax withholdings and contributions. With real-time reporting and integration with attendance and leave records, it provides a seamless, efficient payroll experience for both employers and employees.

Why Automate Payroll in HRM?

Payroll automation reduces manual errors, saves time, and ensures compliance with legal requirements. It also enhances employee satisfaction by ensuring timely and accurate salary disbursements. With the right tools, you can create a scalable and customizable payroll system tailored to your organization’s needs.

Step 1: Define Payroll Requirements

Start by identifying the key features your payroll module needs. Common requirements include:

- Employee salary calculation

- Tax deductions and compliance

- Benefits management (e.g., health insurance, retirement plans)

- Overtime and bonus calculations

- Payroll reporting and analytics

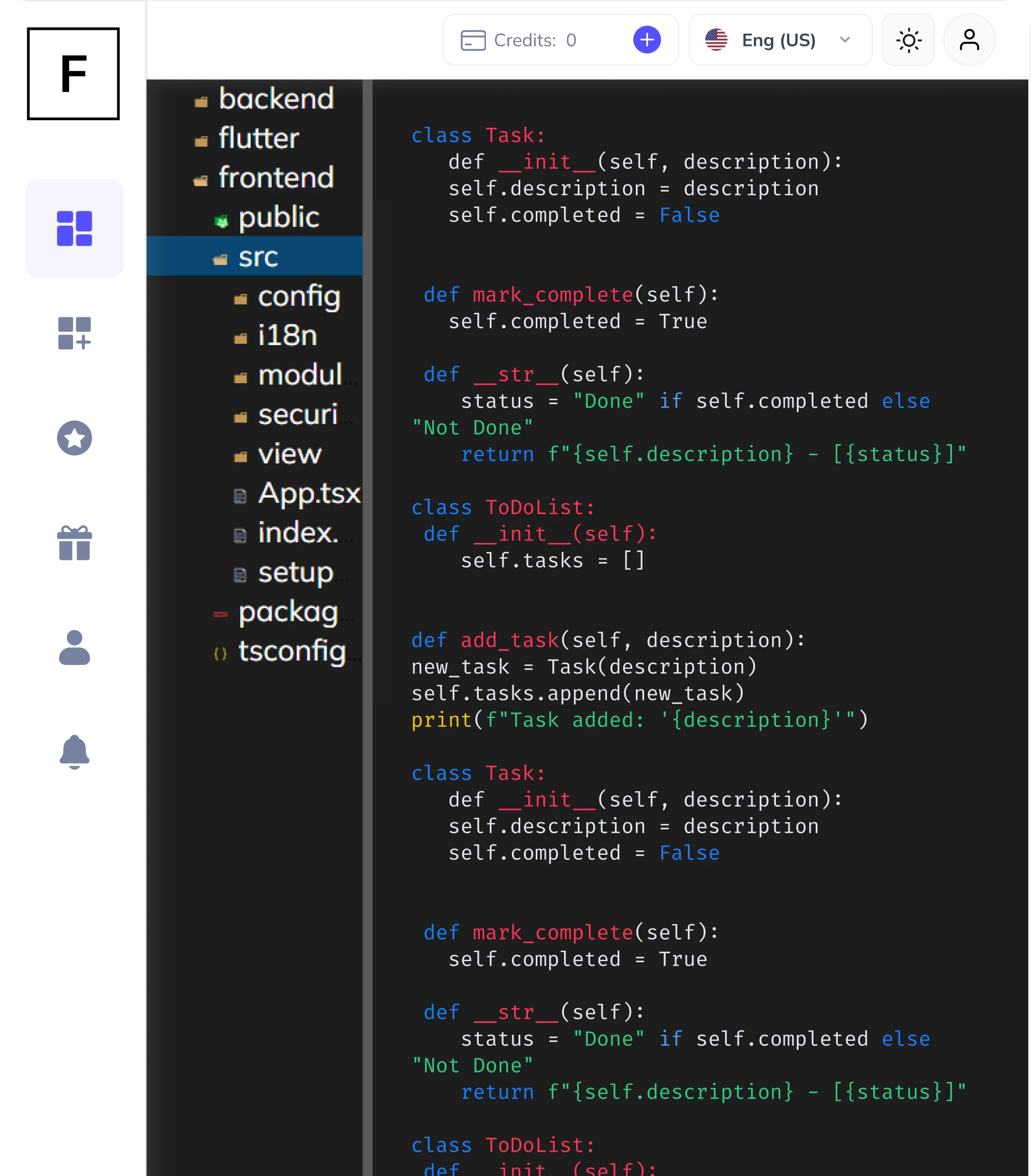

Step 2: Choose the Right Technology Stack

With FAB Builder, you can choose from a variety of technology stacks, including MERN, MEAN, ReactJs, Angular, NodeJs, and more. FAB Builder’s interoperability ensures that your payroll module can adapt to any tech stack, making it future-proof and scalable.

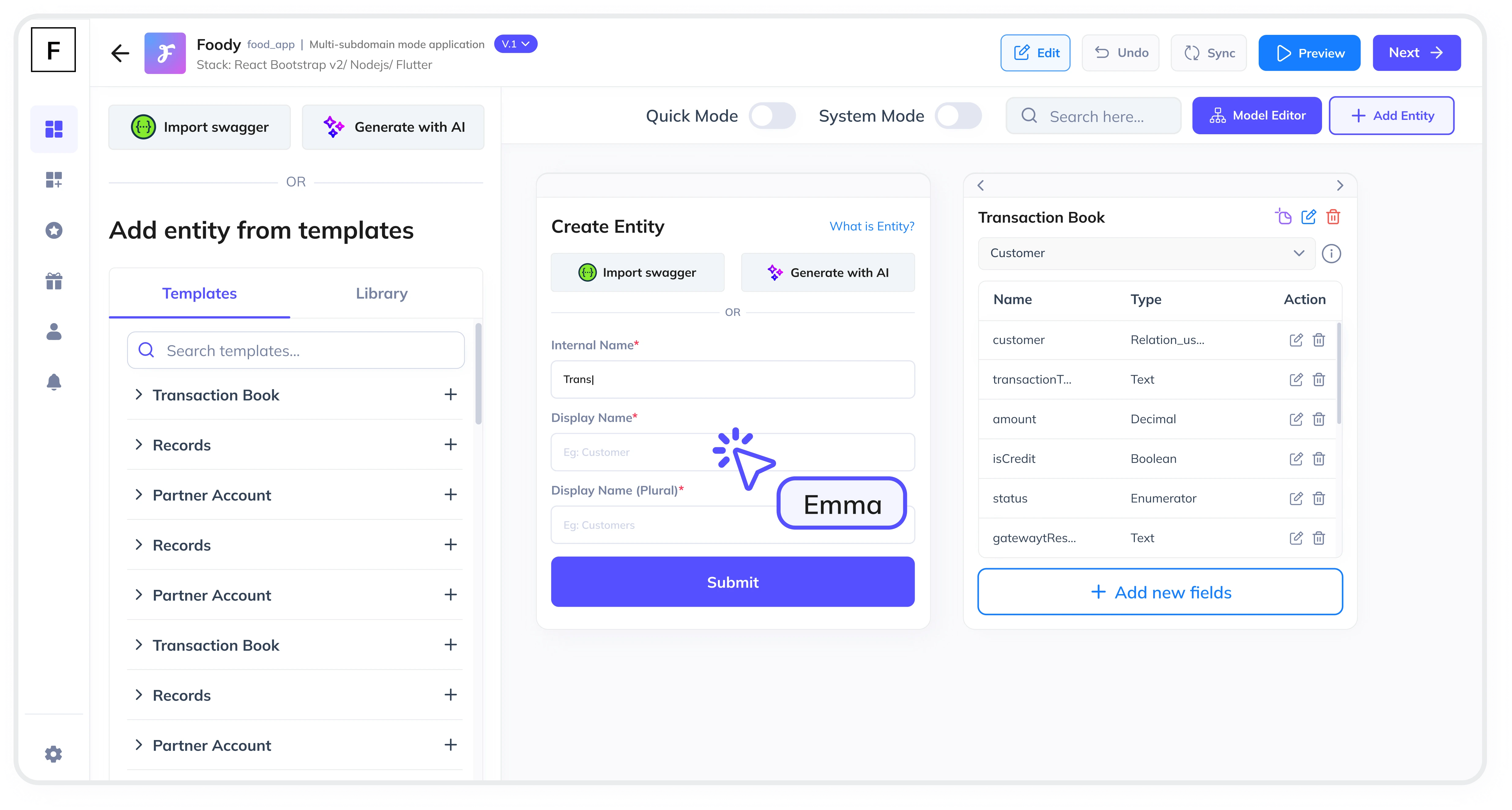

Step 3: Design the Database Schema

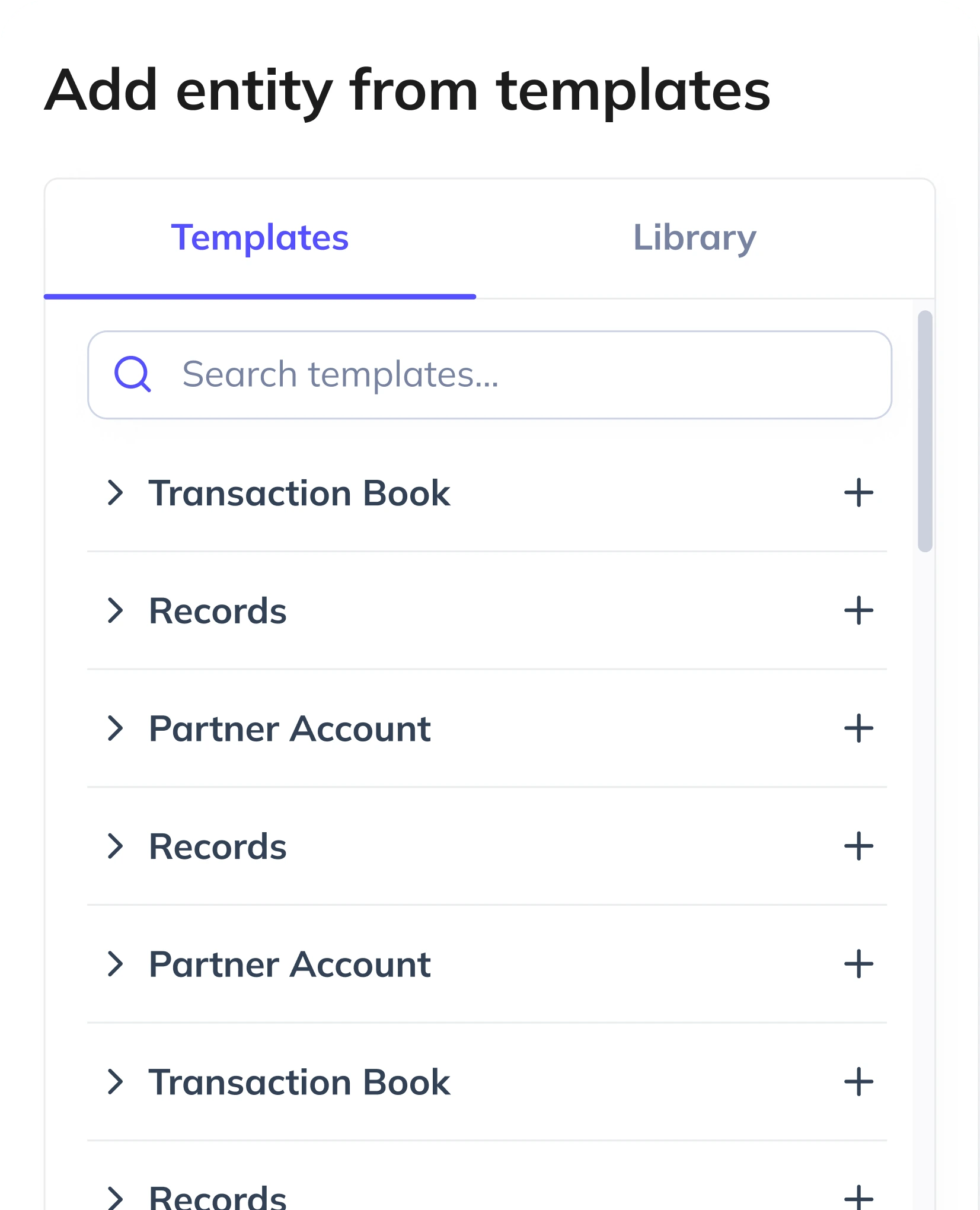

Create a database schema to store employee details, salary structures, tax information, and benefits. FAB Builder’s AI-assisted entity creation simplifies this process by generating the schema based on your application description.

Step 4: Develop the Payroll Calculation Logic

Implement the logic for salary calculations, tax deductions, and benefits management. FAB Builder’s low-code platform allows you to build this logic visually, reducing the need for extensive coding.

Step 5: Integrate Payment Gateways

Integrate payment gateways like Stripe, RazorPay, or PayPal to facilitate salary disbursements. FAB Builder supports seamless integration with multiple payment providers, ensuring flexibility for your payroll system.

Step 6: Add Role-Based Permissions

Ensure that only authorized personnel can access sensitive payroll data. FAB Builder’s role-based permission system allows you to control access to different features and data within the payroll module.

Step 7: Enable Bulk Data Import/Export

FAB Builder automatically generates Excel templates for bulk data import and export. This feature is particularly useful for managing large datasets, such as employee records and payroll reports.

Step 8: Configure File Storage

Choose a file storage provider (e.g., AWS S3, Google Cloud Storage) to store payroll-related documents securely. FAB Builder’s configurable file storage system ensures flexibility and scalability.

Step 9: Test and Deploy

Test the payroll module thoroughly to ensure accuracy and compliance. Once tested, deploy the module to your preferred cloud platform (AWS, GCP, or Azure) with just one click using FAB Builder’s managed hosting services.

Step 10: Monitor and Optimize

Continuously monitor the payroll module’s performance and make optimizations as needed. FAB Builder’s extensible architecture allows you to add new features or modify existing ones without disrupting the system.

Why Choose FAB Builder?

FAB Builder is not just a low-code platform; it’s a complete solution for building scalable, customizable applications. With features like:

- Downloadable source code with full intellectual property rights

- Multi-tenant configurations for SaaS applications

- Flexible file storage options (AWS S3, Google Cloud Storage, etc.)

- Role-based permissions and multi-layer security

FAB Builder empowers businesses to innovate and scale without limitations.

Conclusion

Creating a Payroll Automation Module for HRM doesn’t have to be complicated. With FAB Builder’s low-code platform, you can streamline payroll processing, ensure accuracy, and manage compliance with ease. Whether you’re building an MVP or a production-ready application, FAB Builder provides the tools and flexibility you need to succeed.

Ready to build your Payroll Automation Module?

Explore FAB Builder today and take your HRM system to the next level.